Berlin Rental Market 2025: Rents Are Rising Fast — and Investors Are Taking Notice

Berlin’s Real Estate Market: Demand Keeps Surging

Berlin’s real estate market continues to attract global attention. Once famous for its affordable rents, the city has evolved into one of Europe’s fastest-growing property markets.

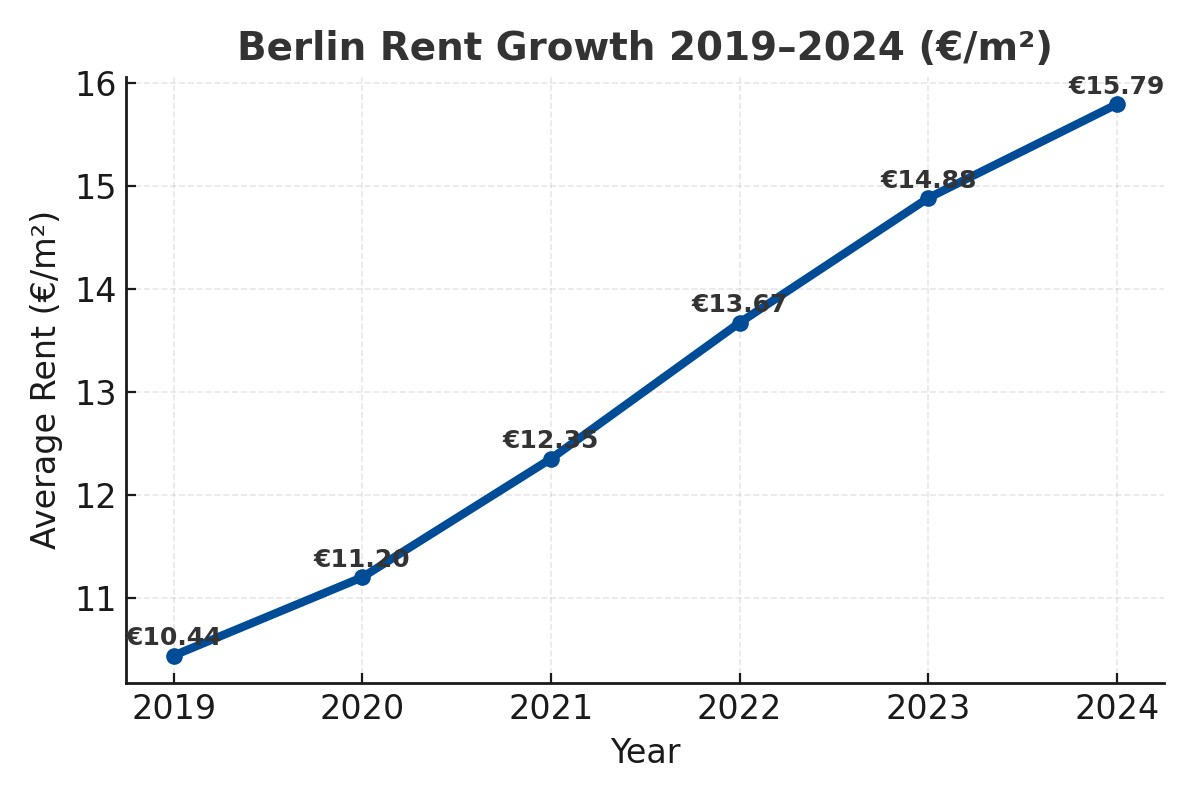

Between 2019 and 2024, average asking rents in Berlin jumped by 51.2%, outpacing every other major German city — a signal of just how strong the rental demand in Berlin has become.

With 3.9 million residents and a vacancy rate of just 0.3%, housing supply simply cannot keep up with demand. For investors, this imbalance translates into high yields, stable occupancy, and strong long-term growth potential.

Berlin Rent Prices in 2024: The Numbers Behind the Boom

In 2019, average rents in Berlin were €10.44/m².

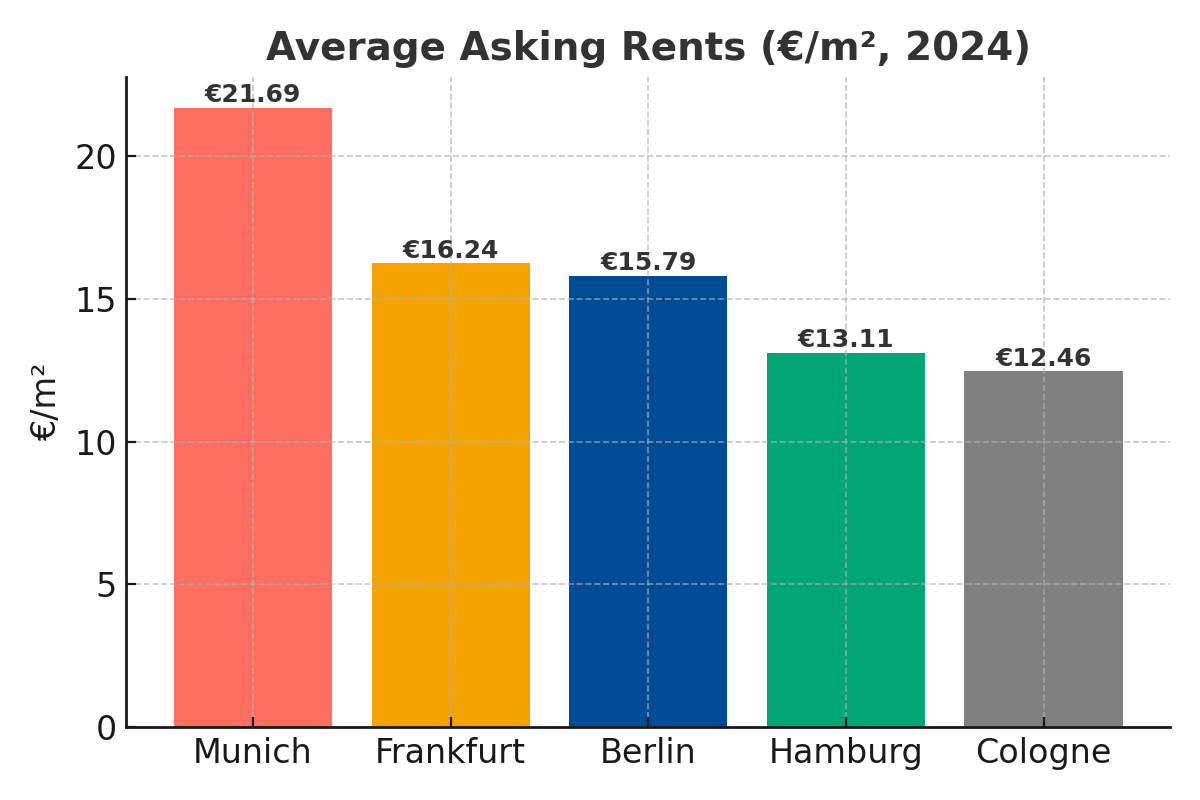

By 2024, they had surged to €15.79/m², placing Berlin as the third most expensive city in Germany, behind Munich (€21.69/m²) and Frankfurt (€16.24/m²).

While other German markets — such as Hamburg (+25.5%) and Cologne (+19.2%) — grew steadily, Berlin rents rose twice as fast, fueled by strong economic fundamentals and urban migration.

Why Are Berlin Rents Increasing So Quickly?

The Berlin rental market is driven by a combination of structural and economic factors:

- 🏗️ Housing undersupply: Berlin needs more than 222,000 new apartments by 2040, but construction remains far below target.

- 📉 Near-zero vacancy: Only 0.3% of rental housing is available — an extremely tight market.

- 🌍 Population growth: The city continues to attract both local and international residents, especially young professionals.

- 💼 Strong income growth: Inflow of higher-income tenants pushes rents upward in central and emerging districts.

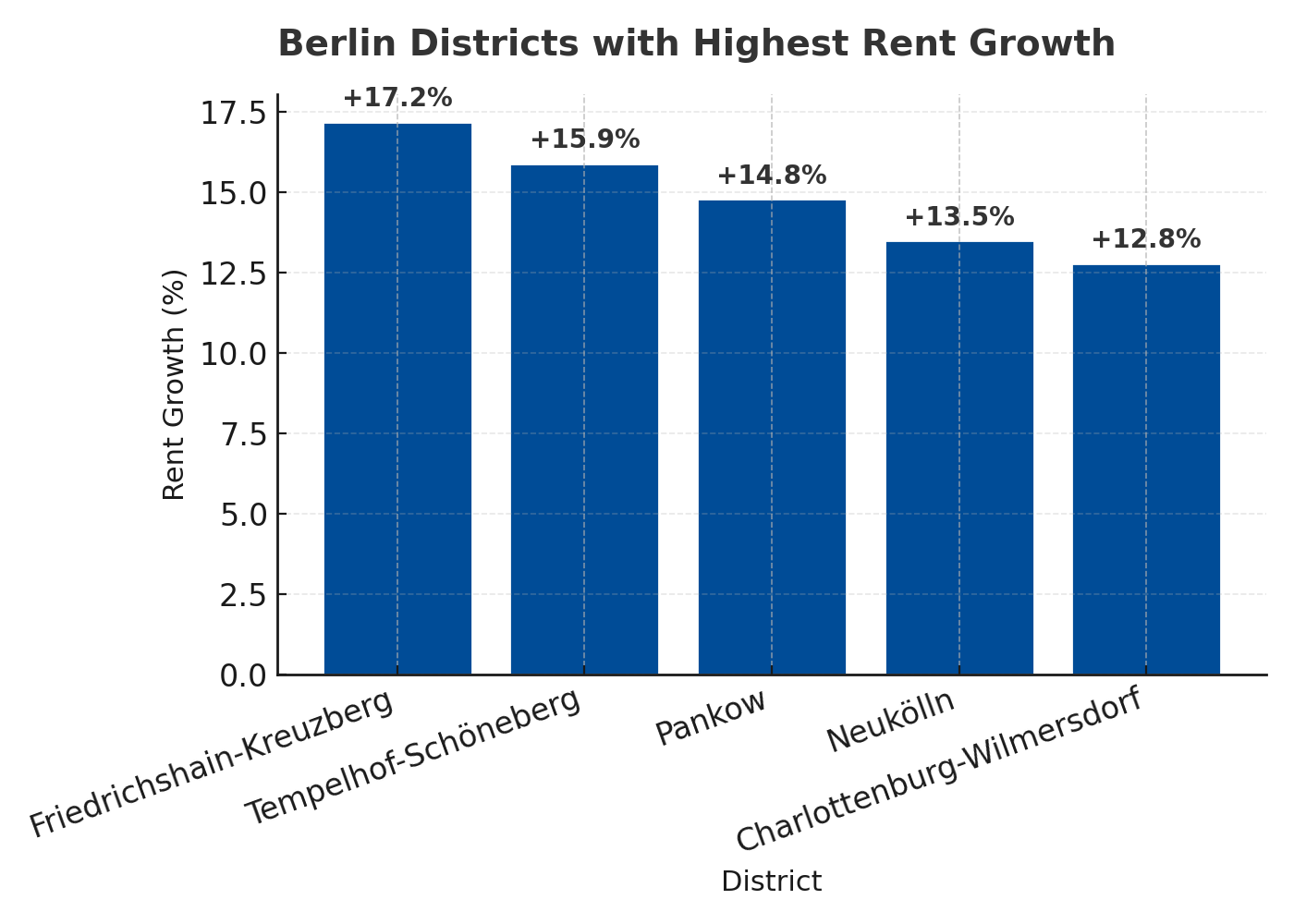

Districts Showing the Fastest Rent Growth

Certain Berlin neighborhoods have become hotspots for rental price growth:

- Friedrichshain-Kreuzberg: +17.2%

- Tempelhof-Schöneberg: +15.9%

- Pankow: +14.8%

These figures reveal that the rental boom in Berlin is not limited to central areas — it’s spreading outward, creating new investment opportunities in up-and-coming districts.

Why Berlin Real Estate Is Still an Opportunity

Despite the surge in rental prices, Berlin remains relatively affordable compared to other European capitals.

In 2024, the average condominium price stood at €5,696/m², well below Munich (€8,852) and Frankfurt (€6,500).

For investors, that means lower entry costs, strong rental yields, and long-term appreciation potential in a city that continues to grow faster than it can build.

Key Takeaways for Investors

✅ 51% rent increase in five years — fastest among German cities.

✅ Vacancy at 0.3% — nearly full occupancy ensures consistent returns.

✅ High demand from international residents and professionals.

✅ Property prices still competitive — ideal for mid- to long-term investment.

Conclusion: Berlin’s Rental Boom Is Just Beginning

The Berlin real estate market in 2025 stands as one of Europe’s most promising investment landscapes.

With rapid rent growth, chronic housing shortages, and stable economic fundamentals, the city offers a combination of security and upside rarely found in other European capitals.

For investors seeking predictable rental income and long-term capital appreciation, Berlin remains a standout destination — where high demand meets real opportunity.