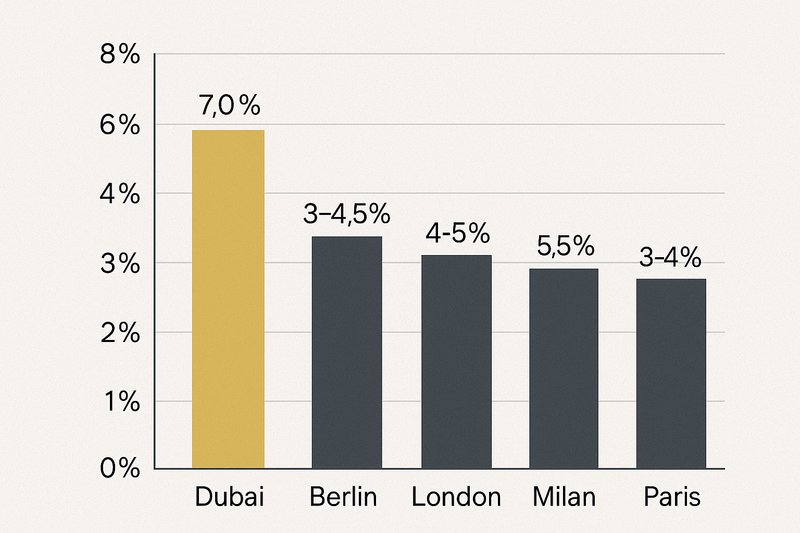

Rental Yields in Dubai vs Major European Cities: A Comparative Guide

For European investors looking beyond local markets, Dubai stands out in 2025 as a real estate destination offering high rental income and strong demand. In this concise guide, we compare Dubai’s rental yields with major European cities and outline what makes it an attractive opportunity.

Understanding Rental Yield

Rental yield measures how much rental income a property generates compared to its purchase price:

Gross Rental Yield (%) = (Annual Rent / Property Price) × 100

It’s a quick way to compare markets — the higher the yield, the greater the potential return on investment.

Dubai’s Rental Yield in 2025

Dubai continues to outperform most global markets.

- Average gross rental yields range between 6% and 8% for apartments.

- Villas average around 5%, while smaller units in central locations can exceed 8%.

- Districts like Jumeirah Village Circle, Dubai Hills Estate, and Downtown show consistent rental demand from both residents and expats.

- The absence of property and capital gains tax further enhances Dubai’s net returns.

Takeaway: Dubai delivers some of the highest rental yields worldwide, especially compared to European capitals.

Yields Across Major European Cities

In contrast, European cities offer lower returns due to higher property prices and stricter regulation.

Takeaway: Even top European markets struggle to reach the mid-single-digit yields that are standard in Dubai.

Why Dubai Outperforms

- High rental demand from expatriates and international tenants.

- No property or income taxes on most real estate investments.

- Lower purchase prices relative to rent levels.

- Strong infrastructure and continuous population growth.

For European investors, this means greater cash flow potential and a faster return on investment — provided the property is well-chosen and professionally managed.

Key Considerations

While yields are strong, investors should remain realistic:

- New construction could increase supply in some districts.

- Net yield (after fees and maintenance) will be slightly lower than gross.

- Currency fluctuations between the euro and the dirham can affect final returns.

- Always check tax implications in your home country.

Strategic Tips for European Investors

- Focus on smaller apartments with proven rental demand.

- Choose emerging communities with growth potential rather than only luxury zones.

- Use professional property management to protect occupancy and maintenance quality.

- Think long-term: combine rental yield with capital appreciation potential.

- Diversify between Dubai and European holdings to balance income and risk.

Conclusion

Dubai’s rental yields — averaging 6–8% compared to Europe’s 3–5% — highlight why the city continues to attract global investors. For Europeans seeking solid, tax-efficient income and portfolio diversification, Dubai represents one of the most dynamic real estate markets in 2025.